The well-known chain of video game stores deflates after a few days that will go down in modern Wall Street history. What is happening now?

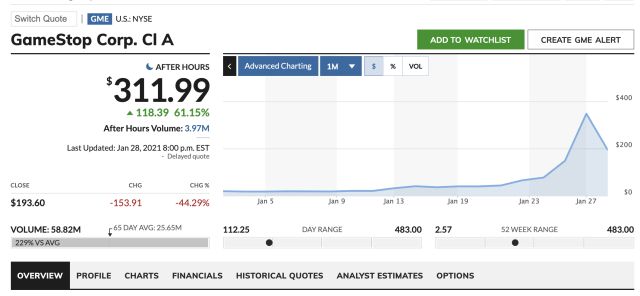

The history of GameStop in the stock market continues. After a historic week marked by a superlative increase in the value of the company in the stock market after the action of a group of Reddit investors, WallStreetBets, the shares of the well-known chain of stores have collapsed on the day of this Thursday 28 from January.

What meant going from a value of just over $ 20 to a maximum range of $ 480 at noon this Thursday, has gone on to close the day at $ 193. The reason is none other than a strategy surrounded by controversy: the blocking of the purchase of shares by Robinhood.

GameStop

What is Robinhood and what is the reason for the anger

First of all, we have to understand what Robinhood is. Reddit users of the WallStreetBets subforum, like other retail share buyers, trade the stock market through apps, and this is one of them. The anger came at the time when Robinhood made the decision to join others such as TD Ameritrade to prohibit the purchase of securities such as Gamestop to stop its increase in the stock market and counteract the loss of money of those who bet short (shorting) hoping that the trend continued downward throughout the month of January. We are talking about estimates of more than 5 billion dollars in losses for those – in many cases – great wealth.

The Southern District court has filed a class action lawsuit claiming that retail investors have been deprived of “the ability to invest in the open market in an attempt to manipulate it. […] Robinhood purposely and knowingly removed the GME (GameStop) stock from its trading platform amid an unprecedented stock market rise, ”they allege in the complaint, signed by Brendon Nelson.

Rebellion against Robinhood; AOC and Elon Musk position themselves

For her part, the Democratic congresswoman, Alexandria Ocasio-Cortez, has raised her voice on the social network Twitter for this situation, since it manipulates, they say, a basic rule of the stock market such as the freedom to operate knowing the risk that it can carry a gamble, both for better and for worse. Elon Musk, in an equally successful response, has ratified the words of the policy.

This is unacceptable.

We now need to know more about @ RobinhoodApp’s decision to block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit.

As a member of the Financial Services Cmte, I’d support a hearing if necessary. https://t.co/4Qyrolgzyt

– Alexandria Ocasio-Cortez (@AOC) January 28, 2021

WallStreetBets users and tens of thousands of other users have rebelled against Robinhood with scores of one star out of five in the app’s valuation, destroying his name’s reputation in the public eye and compromising his position in searches. through the algorithm of these stores.

Finally, Dave Portnow, a benchmark in the investment world and founder of Barstool Sports, has called for prison for those responsible for Robinhood and other platforms that are prohibiting the purchase of Gamestop shares; that is to say, paralyzing the market.

References | MarketWatch; GRAZE; The Economist; Polygon; Alexandria Ocasio-Cortez; Elon Musk; Dave portnow